Preparing interim figures quarterly and half-yearly, is it useful or not?

What is in a budget

In the budget, you indicate what you expect, a forecast as it were, but you also describe which resources you need to achieve the expected results and objectives.

A budget is a financial plan that is drawn up to plan and manage the expected income and expenditure for a certain period, usually a year.

What is the purpose of a budget

It enables organizations to make and substantiate plans for the future, often the coming financial year.

The purpose of a budget is to ensure financial stability and manage the financial health of a company, business or organization during the financial year.

Free example reports and brochures

View and download a free sample liquidity budget here. With the Speedbooks sample liquidity budget you can see how easy it is to create a liquidity budget.

Download the Speedbooks® sample reports and brochures for free and experience the ease and benefits yourself.

How to make a budget

It starts with collecting all kinds of financial data. Such as historical income and expenditure, balance sheet information and possibly market research.

Then(in addition) you set clear financial goals for the budget period regarding expected growth, costs (savings) and profit maximization.

Finally, in order to be able to draw up a reliable budget, you need good prognoses and forecasts to base your insights, objectives and plans on.

Short history lesson

A prognosis and/or forecast is a prediction based on your current results and realistic expectations.

The word prognosis is derived from the Greek word prognosis and literally means: foreknowledge.

Happy New Year

When the new year has begun, you start with great enthusiasm. But just like every year, you are confronted with sudden developments, a recession, a virus, a war… or opportunities.

During the year, you regularly monitor the actual performance compared to the budget. In the meantime, you evaluate the performance by creating interim figures and you use these figures and insights to adjust the budget, adjust policy and goals in a timely manner.

Long-term effects

The (financial) expectations resulting from developments within your industry, the market and the general economy, locally, nationally and internationally, will certainly have a greater or lesser influence on your company in the near or distant future.

In the form of threats or opportunities, but in any case, you want to be able to respond to all possible developments.

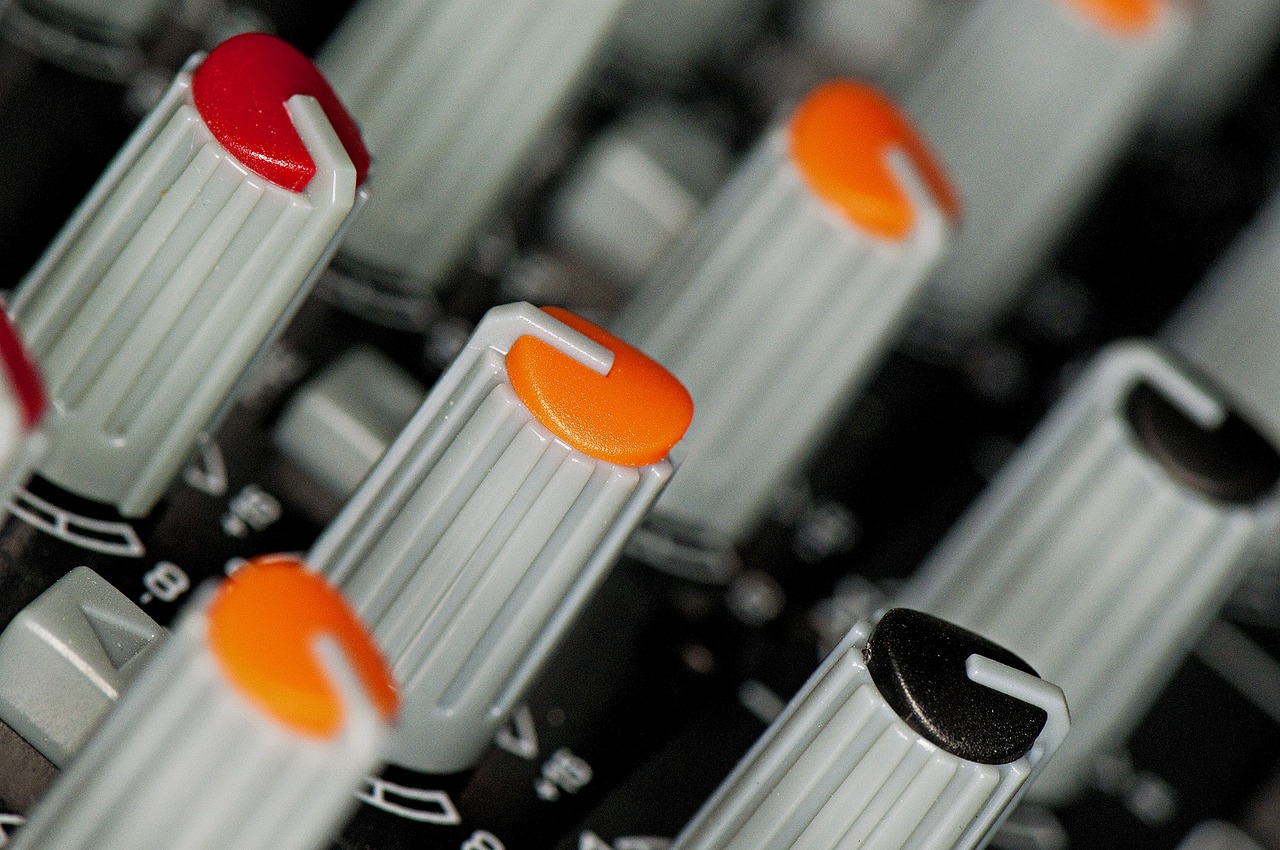

Taking measurements

Entrepreneurship is constantly having your fingers on the buttons and being able to respond to changes and developments.

As stated earlier, you have to keep an eye on things and know whether things are going as expected. Or whether adjustments to the policy may be necessary. There is only one way to do this, by turning the financial buttons.

Financial security, liquidity in order

This is the only way to properly control that there is sufficient money 'in the till' to meet all current obligations and to make a profit in the long term.

Liquidity ensures that a company can cover daily operational costs, such as wages, rent, supplier payments and utilities.

Sufficient liquidity is essential for the financial stability, growth and resilience of a company. It enables the company to continue to function smoothly, manage risks and seize opportunities, which contributes to its long-term success.

Sufficient liquidity; must and trust

Liquidity gives a company the flexibility to respond quickly to changing market conditions. For example, it can more easily invest in new projects, develop products or adapt to new trends.

Having sufficient liquidity inspires confidence among investors, lenders and suppliers. It shows that the company is financially stable and able to meet its obligations.

Reports of your data in an instant

The relevant data for an interim report from your accounting software can easily be converted into clear reports using reporting software, such as Speedbooks®. This way you can quickly provide yourself or, for example, the management of an organization with the latest financial insights.

Without extensive spreadsheets and a flood of figures. This data can also be displayed both in figures and graphically in the online financial dashboard. Real time, 24/7 and worldwide!

Prepare interim figures for Q1,2,3,4

In business, by accountants and other financial professionals, a quarter is often referred to as ‘Q'. Under normal circumstances, it is advisable to prepare the figures at least every three months or every past quarter. With these figures you can monitor policy and goals.

Managers use quarterly figures or interim figures to make decisions about the business operations. If the interim figures from the accounts indicate that the company, the enterprise is not performing as expected, they can anticipate this, adjust strategies in time, control costs or reconsider growth plans.

Stressed reality, recession and crisis

During turbulent or uncertain times, it is even better to compare the actual figures from your administration with the figures from your forecasts every month, via a monthly report. With these figures, you can quickly switch in terms of your business operations.

Monthly financial figures provide a real-time overview of financial health. This enables managers to quickly respond to changing circumstances, such as a sudden drop in demand or disruptions in the supply chain.

Transparency during a crisis

During a crisis, investors, financial institutions and other stakeholders often pay more attention to the numbers.

Monthly financial reports provide transparency and trust, which is crucial to maintain support and reassure investors.

Who do you make periodic figures for?

With interim figures, a quarterly figures report and/or half-yearly report or interim annual accounts (with interim profit and loss account), drawn up internally or by the accountants, you inform all stakeholders and interested parties about the state of affairs.

Company directors and managers can use periodic financial data to make decisions about cost savings, investments, personnel management and other strategic issues in the medium term.

Banks and other lenders rely on current financial data (from an accountant), such as quarterly figures, to assess the creditworthiness of companies when applying for financing.

Investors follow periodic figures to assess confidence in companies and markets.

Continuously in motion

In practice, you actually draw up the interim financial situation throughout the year in the form of interim figures, a monthly report, a quarterly or Q 1,2,3 or 4 report, a half-yearly report or interim annual accounts (with interim profit and loss account) and ultimately, after the end of the financial year, of course, the annual financial report or annual accounts (audited by an accountant).

Continuous insight into financial matters

And you also adjust your forecasts based on the current figures, so that you have continuous insight into the possible positive or negative consequences of the state of affairs and can adjust your policy accordingly.

By regularly making an up-to-date liquidity forecast and operating budget, you have everything under control.

Budget can be adjusted, timely adjustments

When changes occur in the internal or external circumstances of your company or business and therefore your financial situation, such as a change in market demand, new competition, changes in tax laws or changes in the cost of raw materials, you must revise the budget to adapt it to the new reality.

Some companies have to deal with seasonal fluctuations in demand. In such cases, you must adjust the budget to take seasonal influences into account and ensure that you have sufficient working capital to absorb these peaks and troughs.

Is a forecast the same as a prognosis?

In practice, the terms "financial forecast" and "financial projection" are often used interchangeably and can have the same meaning in many contexts.

Both terms refer to an estimate or prediction of a company's future financial performance based on historical data, trends, assumptions, and other relevant information.

Difference between a forecast and a forecast

A financial forecast is usually shorter-term, such as a forecast for the coming months or year. It is often focused on planning operational activities, budgeting, and managing the day-to-day finances of a business.

A financial forecast can be a broader term that includes a prediction of financial performance over the medium to long term, for example, the next three to five years. This can serve as a strategic tool for assessing growth opportunities, investment decisions, and general business planning.

Is a forecast the same as a budget

Yes and no. Both are financial planning tools that a company or business uses to predict future financial performance, but there are differences.

A forecast is a prediction based on old figures and expectations and is used to base the budget on.

What is in a forecast

A forecast often concerns a specific topic, such as sales or profits. The main purpose is to gain insight into expected future performance, usually in the medium to long term (for example, for the next three to five years).

The results of forecasts are often used by a company as a strategic tool for planning growth, assessing investment decisions and formulating long-term strategies.

Is a budget the same as a forecast

It is a detailed estimate or forecast of expected income and expenditure for a period. Using forecasts, you determine in the budget which funds or budgets are available for the various organizational units.

A budget usually relates to a short(er) term and is aimed at planning operational activities and managing financial resources in that short term.

Why a budget

Most of the time, budgets are drawn up for (managers of) departments, so that they have a financial framework within which they can make independent decisions.

For example, to invest in something or to spend on advertising and marketing.

Is a budget dynamic or static

A budget is usually more detailed and specific, with set goals and spending limits for a specific period. It is intended to be adhered to and offers less room for change compared to a forecast.

A budget is therefore generally static and target-oriented, but can of course be adjusted based on interim results.

Interim figures or interim annual accounts are a good indicator

Half-year figures provide insight into the financial performance and turnover of the company during the first half of the financial year, allowing stakeholders to assess how the company is performing. The figures enable management to assess the financial performance and, if necessary, adjust the company strategy and financial objectives for the remainder of the year.

Half-year figures are often a (legal) requirement to comply with regulations and reporting obligations, such as those of financial supervisors and stock exchange authorities.

Drawing up annual accounts is a financial annual report

Preparing financial statements provides a summary of financial performance and financial position during a financial year.

Preparing financial statements enables management to analyze performance and financial position and gain new insights into decisions about investments, expenditures, growth strategies.

And anticipate other business issues for the coming financial year.

Who else is the annual report intended for

It also provides information for external decision makers, such as investors who are considering investing in the company.

Lenders, such as banks or other financial institutions, use the annual figures to have their analysts assess the creditworthiness of an organization when applying for financing.

The annual report with the annual figures provides insight into the financial affairs of the company. The annual report consists of important financial information for the shareholders, such as profitability, and therefore the growth of their investments.

About the author drs. Konstantijn Mikes

Founder, inventor and shareholder of Speedbooks reporting software Konstantijn Mikes (1966) is a graduate economist. He studied Economics at the leading Erasmus University in Rotterdam.

At Speedbooks he is responsible for the content development of the reporting software, and he manages the internal developers and the external developers.